Menu

Menu

Choose your Provider for

One of the most valuable things you can have as you approach the age of 65 is the confidence and peace of mind that comes with knowing that you will soon have Medicare healthcare coverage. However, navigating the Medicare application and plan selection processes can be complicated.

At Neldal Insurance we truly are Medicare experts! We have been helping our clients choose, change, or update their Medicare policies at no charge since the 1990’s. Trust us to uncomplicate Medicare for you, and ensure that the Medicare supplement (Medigap) plan you select is cost effective, easy to understand, and easy to manage.

Let us make this easy, for free.

Please note that your Medicare premium cost is EXACTLY the same with or without our help, and we do not charge a fee for a Medicare consultation. So why not call us to schedule a phone, Zoom, or in-person meeting and let us help you make the Medicare supplement (Medigap) decision that is best for you.

Medicare is the federal health insurance program for:

Medicare Insurance and Prescription drug plans are offered by insurance companies and other private companies approved by Medicare. Medicare plans are not offered by the federal government.

As you approach age 65, you’ll need to decide how to deal with some of those coverage gaps. For now, knowing the basics of how Medicare works can help you understand some of the expenses you’ll face.

As you approach age 65, you’ll need to decide how to deal with some of those coverage gaps. For now, knowing the basics of how Medicare works can help you understand some of the expenses you’ll face.

We have created a form that will help make this process as effortless as possible for all parties.

Please take the time to fill out your information and one of our agents will contact you within two business days.

Any Question is a good question

If this doesn’t clear it up for you, feel free to contact us directly! We’re here to help!

Medicare is a federal medical insurance and medical prescription drug program for:

Medicare Insurance Plans and Prescription Plans are offered by insurance companies and other private companies approved by Medicare.

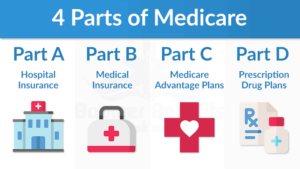

Medicare Part A = Hospital Insurance

Hospital insurance covers inpatient hospital care, skilled nursing facility, hospice care, lab tests, surgery, and some home health care.

Medicare Part B = Medical Insurance

Covers certain doctor’s services, outpatient care, medical supplies, and preventative services.

Medicare Part C = Medicare Advantage Plans

Medicare Advantage (also known as Part C) is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Part D is prescription drug coverage that follows the same rules as Medicare Prescription Drug Plans.

Medicare Part D = Prescription Drug Plans

Medicare Drug Coverage helps pay for your prescription drugs, may lower your costs, and may protect against higher costs. To get Medicare drug coverage, you must join a Medicare approved plan that offers drug coverage. Each plan can vary ion cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare coverage includes generic and brand name drugs. Different plans cover different prescription drugs in different way. The list of prescription drugs they cover is called a formulary and they place drugs into different “cost tiers” on their formularies. These plans also have different monthly premiums. Also, how much you pay for each drug will depend on the plan that you choose.

“Original Medicare” may make sense for you if you have continuing coverage from a former employer, Union, or Medicaid, or under other circumstances.

With “Original Medicare” you pay for services as you get them. When you get services, you’ll pay a deductible at the start of each year, and you usually pay 20% o the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate plan (Part D). Original Medicare pays for much, but not all, of the cost for covered services and supplies.

A Medicare Supplement Insurance (Medigap Policy) can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that “original Medicare” doesn’t cover, like medical care when you travel outside the U.S.

Medicare supplement plans assist with health care costs that Original Medicare may not cover. Original Medicare pays for much, but not all, of the cost for covered services and supplies. A Medicare Supplement Insurance (Medigap Policy) can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that “original Medicare” doesn’t cover, like medical care when you travel outside the U.S.

If you are already receiving your Social Security benefits, then you will be automatically enrolled in Medicare Parts A & B.

If you are not receiving your Social Security benefits, then you should sign up for Medicare 3 months before your 65th birthday using the online application at the Social Security Administration website: ssa.gov

Don’t worry, Neldal Insurance is here to help you. Make an appointment with us and we can help you sort it all out.

Bring your red, white, and blue Medicare card, all other insurance cards you have, and any Medicare health or drug plan enrollment documents or cards that you have to your appointment with your Neldal Insurance agent, and we can help you sort it out.

If you’re eligible for Medicare when you turn 65, you can sign up during the 7-month period that begins 3 months before the month you turn 65. Use the online application at the Social Security Administration website: ssa.gov

If you are employed by a company with more than 20 employees, you should sign up for Part A when you turn 65. You do not need to enroll in a supplement or prescription drug coverage until you lose your employee group insurance.

If you are employed by a company that has less than 20 employees, you should sign up for Parts A and B when you turn 65. There is no need to enroll in a supplement or prescription drug coverage until you lose your employee group insurance.

If this seems confusing, don’t worry! Just make an appointment with us and we will help you get the combination of parts, plans and coverages that you need!

You could be subject to penalties that you will be required to pay for as long as you are on Medicare.

If you enroll in a supplemental policy during your open enrollment period, then NO, you do not have to answer medical questions.

No. You will need to enroll in a stand-alone prescription drug plan.

If your doctor accepts Medicare, then yes, you can keep your doctor.

team@neldal.com

(979) 848-8717

(866) 246-5945